Lets you tap home equity without disturbing the main mortgage (nice if you've locked in a low rate).

Typically lower upfront costs than home equity loans.

Lower rate of interest than with charge card.

Usually low or no closing expenses.

Interest charged only on the quantity of money you use.

- Close X Icon Lenders might need minimum draws.

- Close X Icon Interest rates can change upward or downward.

- Close X Icon Lenders may charge a range of costs, consisting of yearly fees, application charges, cancellation fees or early closure costs.

- Close X Icon Late or missed out on payments can harm your credit and put your home at threat.

Alternatives to a HELOC

A HELOC is not the ideal choice for every debtor. Depending upon what you require the money for, among these alternative choices may be a better fit:

HELOC vs. home equity loan

While comparable in some ways - they both allow property owners to borrow versus the equity in their homes - HELOCs and home equity loans have a couple of distinct differences. A HELOC functions like a charge card with a revolving credit line and typically has variable rate of interest. A home equity loan functions more like a second mortgage, offering funds upfront in a swelling sum at a fixed interest rate.

HELOC vs. cash-out refinance

A cash-out re-finance replaces your present home mortgage with a bigger mortgage. The difference in between the initial mortgage and the brand-new loan is paid out to you in a lump amount. The main difference between a cash-out re-finance and a HELOC is that a cash-out refinance needs you to replace your current mortgage, while a HELOC leaves your existing mortgage intact; it adds an additional debt to your finances.

With a reverse mortgage, you get an advance on your home equity that you do not have to repay till you leave the home. However, these often featured many fees, and variable interest accrues constantly on the cash you receive. These are likewise just available to older homeowners (62 or older for a Home Equity Conversion Mortgage, the most popular reverse mortgage item, or 55 and older for some proprietary reverse mortgages).

Personal loans might have higher rate of interest than home equity loans, but they do not use your home as collateral. Like a home equity loan, they have actually fixed rates of interest and disburse money in a lump amount.

Next actions to getting a HELOC

Before you begin using for a HELOC, here are some home equity resources to prepare you for the procedure:

What is home equity?

Discover what home equity implies and how you can tap it to pay for home restorations or settle financial obligations, and how to get the best rates.

How to compute your home equity

Follow these actions to calculate just how much equity you have in your home and how to use it through a home equity loan or line of credit (HELOC).

HELOC and home equity loan requirements

Everything you need to learn about HELOC and home equity loan requirements: credit history, DTI ratios and more.

How to buy a HELOC: 10 ways to get the very best HELOC rate

Tips that'll help you conserve cash in the long-term by scoring the very best possible rate on your home equity credit line (HELOC).

FAQs about home equity lines of credit

- What should I search for in a HELOC loan provider?

Caret Down Icon When you're buying a loan provider, you must consider a range of factors. Does the lending institution's requirements around loan-to-value and credit history fit your monetary profile? Do you choose working with a brick-and-mortar lending institution or an online company? What are the policies concerning prepayment, refinancing and changing the credit limit limitation? You also ought to research the business's geographical schedule and customer evaluations.

When you're buying a lending institution, you ought to think about a variety of aspects. Does the lender's requirements around loan-to-value and credit rating fit your financial profile? Do you prefer doing business with a brick-and-mortar loan provider or an online business? What are the policies concerning prepayment, refinancing and adjusting the line of credit limit? You also should research the company's geographic availability and customer evaluations.

Read our Reviews: Home Equity Lender Reviews

- Are HELOC rates fixed?

Caret Down Icon Like credit cards, HELOCs typically have variable interest rates, suggesting the rate you at first receive may rise or fall throughout your draw and payment durations. However, some loan providers have actually begun using alternatives to convert all or part of your variable-rate HELOC into a fixed-rate HELOC, sometimes for an extra fee.

Like charge card, HELOCs normally have variable interest rates, indicating the rate you at first receive may increase or fall during your draw and payment periods. However, some loan providers have begun using choices to convert all or part of your variable-rate HELOC into a fixed-rate HELOC, sometimes for an additional charge.

- Is a HELOC tax deductible?

Caret Down Icon Interest paid on a HELOC is tax deductible as long as it's used to "buy, develop or substantially enhance the taxpayer's home that secures the loan," according to the IRS. Interest is capped at $750,000 on mortgage (combined mortgage and HELOC or home equity loan). So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a home worth $1.2 million, you might just deduct the interest on the first $750,000 of the $900,000 you obtained.

Interest paid on a HELOC is tax deductible as long as it's utilized to "buy, develop or substantially enhance the taxpayer's home that protects the loan," according to the IRS. Interest is topped at $750,000 on mortgage (combined mortgage and HELOC or home equity loan). So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a home worth $1.2 million, you might just deduct the interest on the first $750,000 of the $900,000 you obtained.

If you are using a HELOC for any function besides home enhancement (such as starting a company or combining high-interest debt), you can not deduct interest under the tax law.

- Can you pay off a HELOC early?

Caret Down Icon Depending upon your loan provider, you can settle a HELOC early without being penalized. If you want to prepay, attempt to do it within the interest-only duration so you avoid paying more during the payment time frame. However, some loan providers do charge prepayment charges that might cost approximately a few hundred dollars.

Depending on your loan provider, you can settle a HELOC early without being punished. If you 'd like to prepay, attempt to do it within the interest-only period so you avoid paying more throughout the payment timespan. However, some lending institutions do charge prepayment penalties that might cost as much as a few hundred dollars.

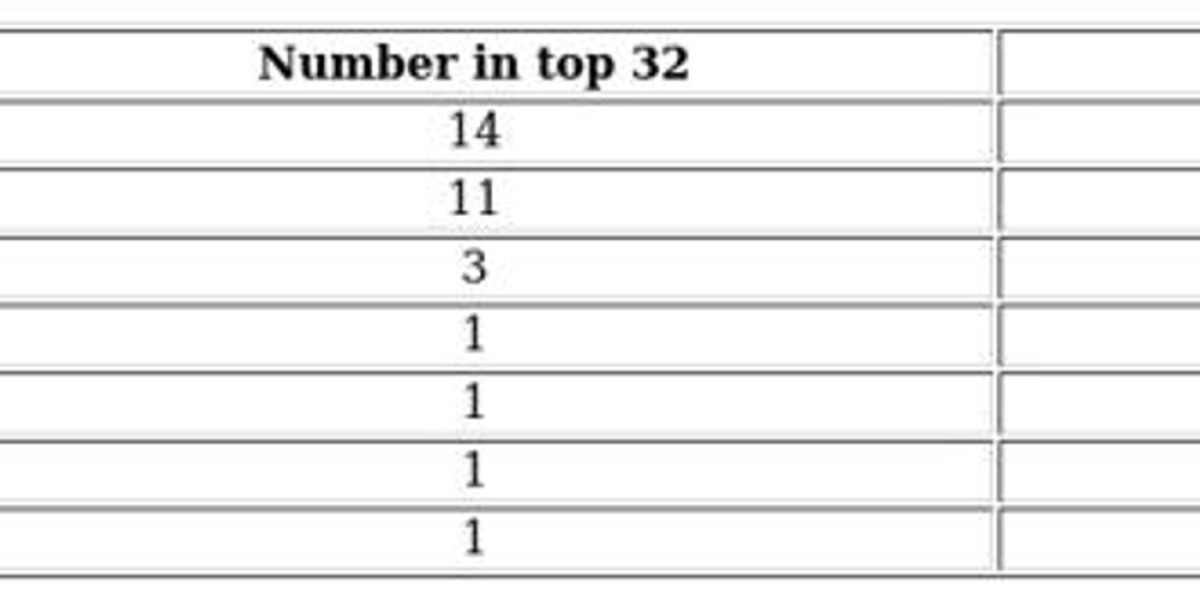

Home equity lenders reviewed by Bankrate

Amerant.

Amplify.

Bank of America.

BMO.

Chase.

Citibank.

Citizens.

Connexus Cooperative Credit Union.

Credit Union of Texas.

Discover.

Fifth Third Bank

Figure.

Flagstar Bank.

FourLeaf Federal Cooperative Credit Union.

Frost Bank.

Homeside.

HSBC.

KeyBank.

Lower.

Northpointe.

PenFed Cooperative Credit Union.

PNC Bank

Police and Fire Federal Credit Union.

Prosper.

Quorum.

Republic Bank and Trust.

Regions Bank.

Rockland Trust Bank.

Spring EQ.

TD Bank.

Third Federal Savings & Loan.

U.S. Bank

Why trust Bankrate?

At Bankrate, our objective is to empower you to make smarter monetary decisions. We've been comparing and surveying banks for more than 40 years to assist you discover the best products for your scenario. Our acclaimed editorial group follows stringent guidelines to ensure our material is not affected by marketers. Additionally, our material is completely reported and vigorously modified to ensure accuracy.

When looking for a HELOC, look for a competitive rate of interest, payment terms that satisfy your requirements and very little costs. Loan details provided here are present as of the publication date. Check the lending institutions' websites for more current details. The top lenders noted below are picked based upon elements such as APR, loan amounts, costs, credit requirements and broad schedule.